© ES-CON JAPAN Ltd.

Sustainability

Risk Management

Risk Management

policy

Through risk management, we strive to ensure the continuity and stable development of our business and to mitigate factors that may impede the interests of ES-CON JAPAN Ltd. stakeholders, including our shareholders, customers, business partners, society, and our officers and employees.

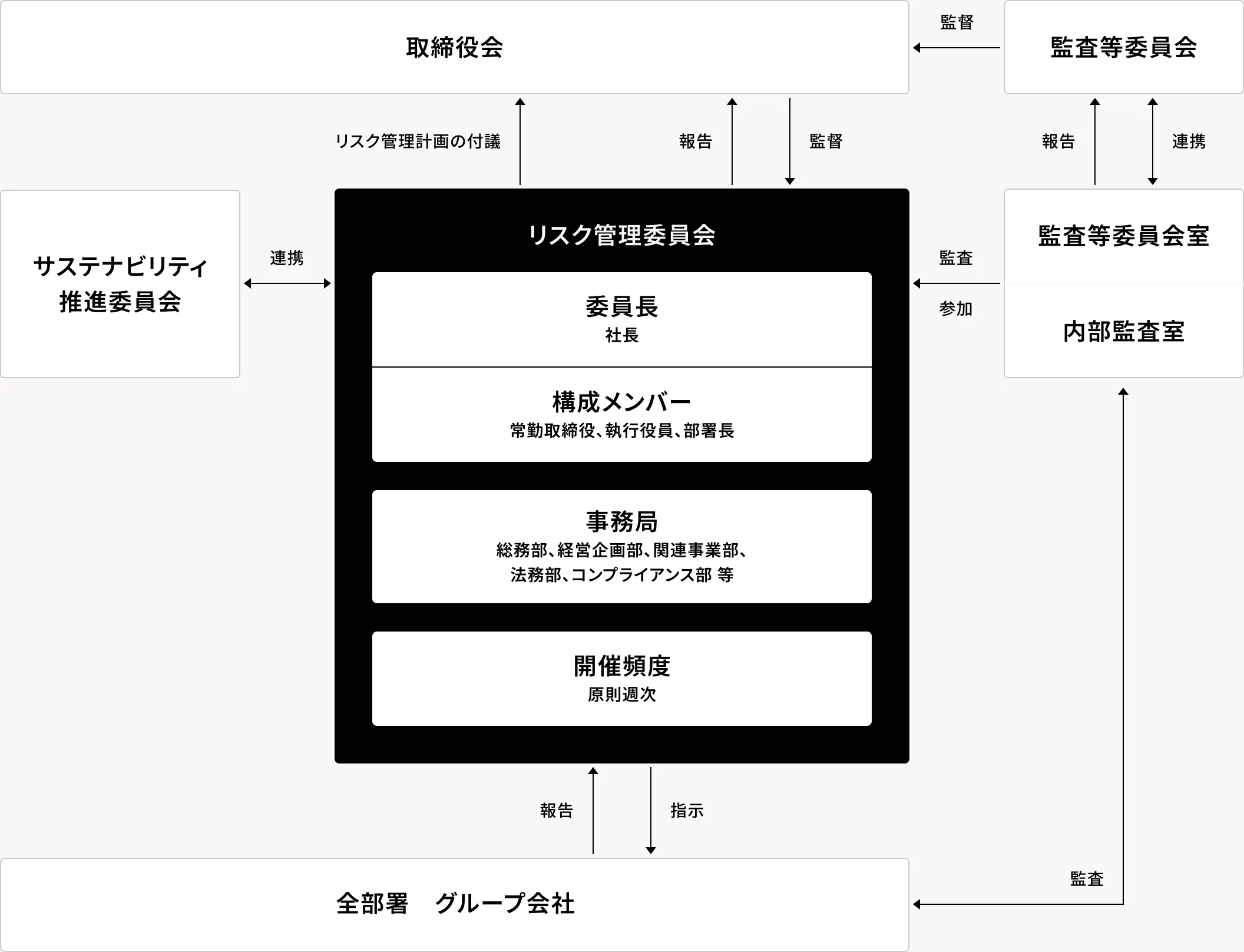

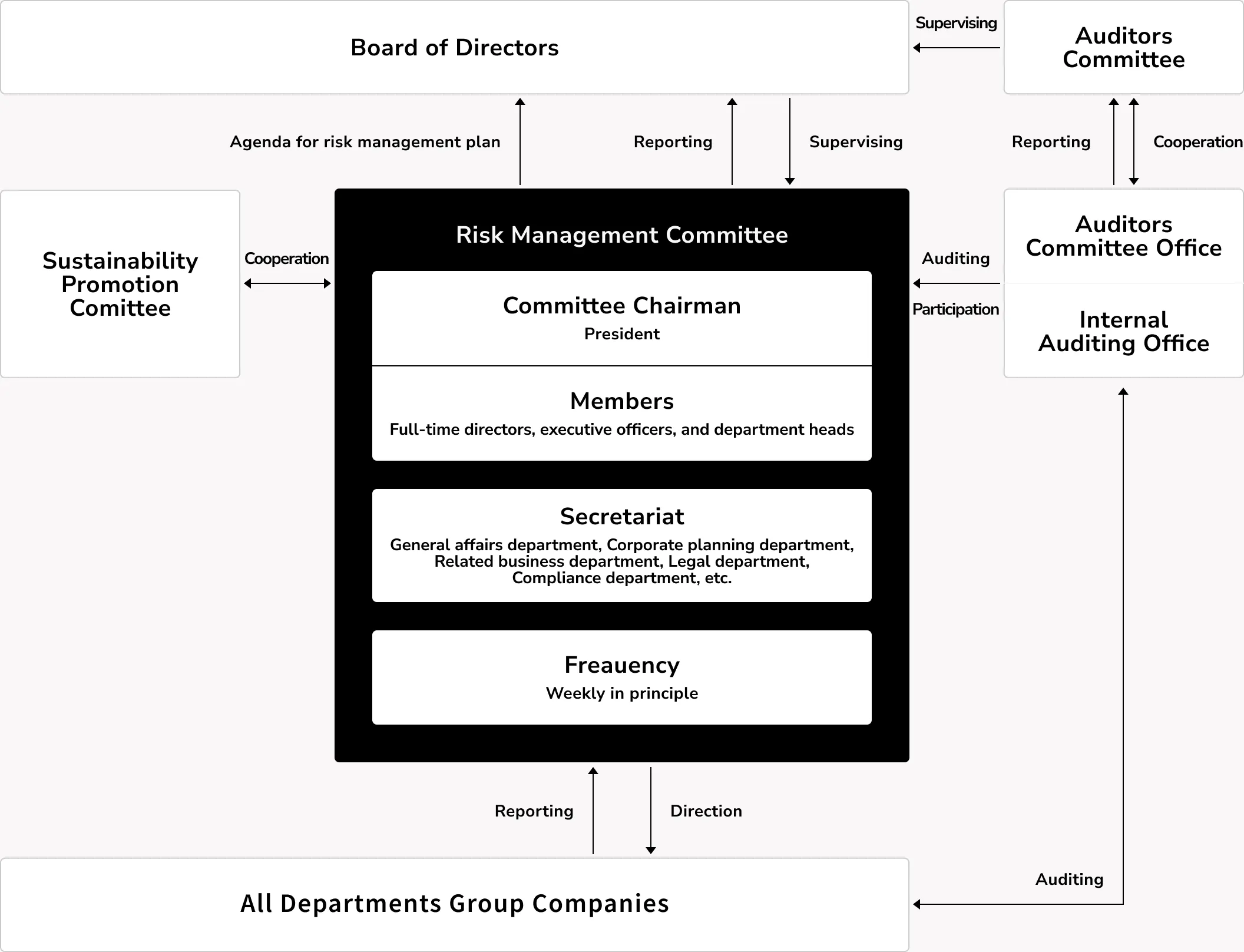

Risk Management System

ES-CON JAPAN Ltd. has established a basic policy for risk management in the "Risk Management Regulations," and has established responses in the event of an emergency in the "Crisis Management Regulations."Regarding risks associated with business projects, the business risks of all initiatives are checked in detail at regular review meetings (Division meetings) attended by executive Director, Director who are full-time Auditor, department heads, and legal affairs personnel, and response policies are decided.In addition, cross-organizational risk status monitoring and company-wide information sharing are carried out at regularly held "Risk Management Committee" meetings.

In addition, the risk management regulations stipulate that Director will annually resolve the "Risk Management Plan," and that the Head of Risk Management will report the progress of the "Risk Management Plan" to the Board Director semi-annually. For fiscal 2024, the "Risk Management Activities for the First Half of Fiscal 2024" will be reported in September, and the "Risk Management Activities for the Second Half of Fiscal 2024" will be reported in March, and the "Risk Management Plan for Fiscal 2025" will also be resolved by the Board Director.

In the event of an incident that has a significant impact on management, a crisis management Division led by President and Representative Director and President will be convened to consider and implement a company-wide response.In addition, to ensure the accuracy and reliability of financial reporting, we identify, assess, and document risks in business processes, etc., based on the policy of the "Internal Control Regulations for Financial Reporting," and regularly check the implementation status of control activities.